Ripple predicted "serious changes" in the structure of the crypto market

2024 will be a period of potential large-scale changes in the structure of the cryptocurrency market in favor of institutional demand, Ripple experts noted in a quarterly report.

Among the significant factors for the transformation, they named the development of the ETF sector, the growing interest of investors in "proxy BTC" in the form of shares of Coinbase, MicroStrategy and public bitcoin miners, as well as regulation.

According to experts, the fourth quarter of 2023 has become significant in terms of widespread adoption of crypto assets. The "historic" October court decision in favor of Grayscale on an application to the SEC to convert a bitcoin trust into an ETF largely provoked bullish sentiment and a rally in the market.

Expectations of industry participants regarding regulatory approval of exchange-traded funds based on the spot price of digital gold have increased dramatically. In January, on the first day alone, the trading volume of 11 products registered by the Commission exceeded $4.5 billion.

The fourth quarter of 2023 was a period of growth for the industry

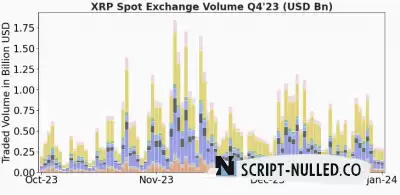

In October-November, the volume of XRP trading in spot pairs increased significantly. The average daily value (ADV) reached $300-450 million, and by the end of the year it stabilized at about $600 million. In general, ADV increased by 75-100% compared to the lows of the third quarter.

This was in line with the general trend in the market. Bitcoin's spot trading volumes increased by 88% in quarterly comparison, and Ethereum's by 140%.

By the end of the year, CME had become the largest platform for trading cryptocurrency futures — in the fourth quarter, open interest jumped by 300% to $6 billion. Although this was largely due to the loss of Binance's market share, migration contributed to the further establishment of digital currencies as a recognized asset class, Ripple experts noted. The beneficiaries of the flow of traders also became decentralized options exchanges, the activity of which jumped by 300%.

Compliance with regulatory requirements has come to the fore

The legal problems of Binance and its founder Changpeng Zhao, as well as the court's decision on ex-FTX CEO Sam Bankman-Fried, demonstrated the importance of compliance, experts say.

In July, Ripple won a partial victory in the process with the SEC. The court ruled that XRP itself is not a security, and considered most of the token sales and distributions unrelated to the offers of investment contracts.

However, this does not apply to a number of asset sales to institutional players. The parties will present their arguments in March-April 2024, after which the court will decide on possible sanctions.

Ripple noted that even before the June court, they changed the way they offered tokens to organizations to comply with regulatory standards.

In the fourth quarter of 2023, the company continued to implement a program to expand regulatory compliance. Ripple has received a full license from a major payment institution from the Monetary Authority of Singapore (MAS), and has registered as a virtual asset service provider in Ireland.

The firm also holds a BitLicense in New York State and has the status of a licensed money transfer provider in 40 other US jurisdictions.

Global regulation of cryptocurrencies contributes to their recognition

According to experts, there was a positive trend in global cryptocurrency regulation in the fourth quarter, despite the ongoing SEC court cases against Coinbase and Kraken.

The Dubai Financial Services Authority (DFSA) has opened external applications for tokens that can be approved for use at the Dubai International Financial Center (DIFC). Ripple was one of the first to take advantage of this opportunity for XRP.

The UK government has announced that it will launch a "sandbox" for digital securities, which will include debt, equity and money market instruments. In addition, the Ministry of Finance of the country will study the banking problems faced by licensed crypto firms in order to stimulate innovation in the region.

Spain has announced that it will seek to implement the EU's fundamental legislation on crypto asset markets (MiCA) six months ahead of the July 2026 deadline.

In Asia, Hong Kong has prepared rules for real-world tokenized assets (RWA). MAS has announced plans for a pilot RWA project in Japan, Switzerland and the UK.

Recall what regulatory changes affected the industry in 2023, ForkLog told in a New Year's material.

Spain

Spain

Portugal

Portugal