Grayscale predicted a "favorable" structure of the bitcoin market after halving

Fundamental changes in the supply-demand ratio, along with other factors, are likely to have a positive impact on bitcoin quotes after halving. This is the conclusion reached at Grayscale.

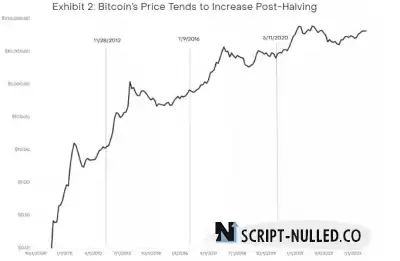

Historical periods of the cryptocurrency's bullish rally followed the halving of the block reward. However, it is important to take into account that "past results do not guarantee future results at all," the specialists of the asset management company stressed.

The relationship between a decrease in the inflow of an asset to the market and quotes is illustrated by the well-known Stock-to-Flow model from trader PlanB.

Grayscale has noticed that this concept overlooks the predictability of scarcity. At the same time, investors are in no hurry to buy bitcoins before halving, thus raising the price, which, according to this theory, will inevitably soar. The example of other cryptocurrencies like Litecoin shows that after the reduction of the block reward, growth will not necessarily follow, the company added.

According to experts, the periods of the bitcoin rally are largely related not to halving, but to coinciding major macroeconomic events. For example, in 2012-2013 it was the European debt crisis, in 2016-2017 it was the $5.6 billion ICO boom, which indirectly affected bitcoin. Large-scale support measures during the COVID—19 pandemic encouraged investors to consider digital gold as a hedge against inflation - by November 2021, the asset reached $68,000.

A completely different post-halving

Without taking into account possible global economic shocks, the situation after the April reduction of the block reward will differ significantly from previous periods of post-halving due to a number of factors. One of them is an ETF, Grayscale analysts stressed.

According to their calculations, the current mining rate of 6.25 BTC per block means an influx of assets worth about $ 14 billion per year at a price of $43,000. To compensate for the sales pressure, an "adequate" flow of funds to the market is necessary.

After the approval of spot exchange-traded bitcoin funds in the United States in January, the products raised approximately $1.5 billion in just the first 15 trading days. Taking into account daily receipts from $1 million to $10 million, instruments at the upper limit are already able to largely absorb the new supply of the asset, which will already decrease. This fundamentally transforms the market model in a positive direction for bitcoin, experts believe.

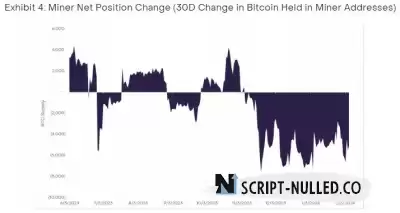

Traditionally, miners are one of the main sellers of digital gold after halving. Since the fourth quarter of 2023, there has been a tendency for them to sell reserves and mined coins.

In recent months, cryptocurrency miners have also significantly strengthened balance sheets, reduced debt burden and increased the efficiency of the park, analysts said. The financial situation of industry players suggests that there will be no major liquidations in the sector.

Another significant factor was the appearance of Ordinals in 2023. "Inscriptions" brought bitcoin miners over $ 200 million in revenue in the form of commissions, supporting the profitability of the work, analysts noted.

Recall that ForkLog has collected the most interesting forecasts of crypto industry experts regarding the prospects for the price of the first cryptocurrency after halving.

Spain

Spain

Portugal

Portugal