Credit Banking Online -Credit management

Credit Banking Software is a comprehensive, comprehensive online credit management system in syndicated, commercial, consumer and mortgage lending that allows credit companies to easily manage their borrowers, loans, repayments and collections while remaining affordable. Our banking solution creates a consistent and uninterrupted experience with digital borrowers for large multinational corporations, medium and small business customers, as well as consumers. Our loan management solution gives you a 360-degree overview of all relationships and facilities under management. Calculations, workflows, financial analysis, electronic compliance and maintenance all work together on a single platform. By eliminating the associated manual processes, re-entry of data, duplication of effort, printing and mailing of documents, our loan management software reduces costs and ensures unavoidable efficiency. This Online joint credit banking software has a simple and intuitive user interface, with advanced workflows that will help you go through all the main processes, and up-to-date data is always at your fingertips.

This loan solution allows you to collect personal information, unique identifiers, information about next of kin, business information and much more. You can upload scanned photos or documents to the client's account. You can also add your own custom fields. This system has a flexible lending and savings module that you can customize according to your microfinance needs. Managed fields include loan term, interest rate, repayment schedule, interest calculation method, fees and many other options. The loan approval process meets the best microfinance standards. You can set up your chart of accounts using GL codes and link them to credit or savings products and many other applicable areas. Some journal entries are made automatically, such as loan repayments, while some can be added manually. You can find various accounting reports such as trial balance sheet, balance sheet and profit and loss statements. View and export high-quality reports. Reports include borrower numbers, loan portfolio, overdue debt reports, savings reports, expected and actual payments, collection statements, reserve formation and much more.

The online loan management software has the following key functions:

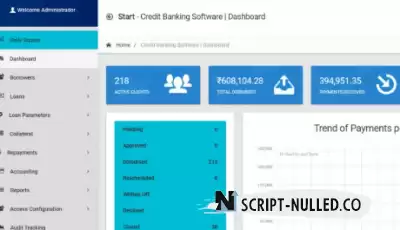

Dashboard

Borrowers

Credit Management – Creating a new loan, credit report, calculator

Credit Parameters – Payment Methods, Route Report, Accrual Report, Officials Report, Guarantor Report, Default Adjustment, Penalty Report, Credit Status, Office Report

Assurance – Report on guarantees, Creation of new guarantees, Types of guarantees

Payments – Payment report, Creation of a new payment

Accounting – Chart of Accounts, General Diary, Accounting book, Manual accounting

Integrated Online

SMS Payment

Access Configuration – User Report, User Roles, Creation of a new user

Audit tracking

My Profile

General configuration

Reports – Customer Reports, Credit Reports, Financial Reports, Administrative Reports

Spain

Spain

Portugal

Portugal