A bearish scenario is unlikely.

"A bearish scenario is unlikely." Experts have estimated the potential of bitcoin after falling below $42,000

The first cryptocurrency collapsed by 15% after the launch of spot bitcoin ETFs.

The experts interviewed by ForkLog allowed a further drawdown and noted the overflow of funds into altcoins.

Despite the predominance of bullish sentiment before the approval of spot bitcoin ETFs, after their launch, the first cryptocurrency sank by almost 15% - from $49,000 to $41,500.

On the evening of January 10, when the SEC approved all applications for exchange-traded funds, digital gold reached two-year highs at the moment, but after the start of trading the next day it began to decline.

At the same time, the cryptocurrency "Fear and Greed Index" dropped to the value of 52, which signals moderate market sentiment.

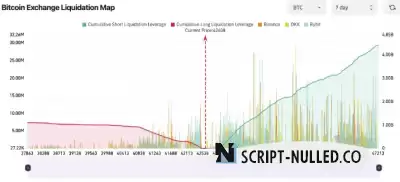

According to Coinglass, over the past seven days, $5.5 billion worth of positions have been liquidated — of which $4.4 billion fell on longs.

In fact, the correction of the first cryptocurrency confirmed the previous fears of analysts about a scenario with a "sale on the news."

Causes and consequences

Gleb Kostarev, ex-director of Binance in Asia and Eastern Europe, said in a ForkLog comment that the sharp decline was due to sales by investors who opened positions on expectations from the adoption of ETFs and are now recording profits.

According to trader Vladimir Cohen, the crypto market had been expecting the appearance of spot bitcoin ETFs for five years, and after submitting the application, BlackRock was "actively warming up with rumors" about the imminent approval of the product.

It is on this narrative that the first cryptocurrency grew by 80% to $46,000, the source believes.

He noted that in the future, the adoption of ETFs is a bullish signal, as it creates "prolonged deferred demand." As the expert explained, fund issuers are not required to buy bitcoin on the spot immediately after the sale of shares. They already have stocks, and the transactions themselves, as a rule, take place on the over-the-counter market, without directly affecting current prices.

According to Anton Toroptsev, regional director of CommEX in Russia and the CIS, the effect of the spot bitcoin ETF has already been taken into account in the asset rate:

In the future, Toroptsev expects a less rapid growth of digital gold, which will occur as institutional capital enters the crypto market in the long term.

Halving of bitcoin is considered the closest driver to growth, but until then, investors will closely monitor the Fed's signals on US monetary policy, the regional director of CommEX said.

Transfusion into altcoins

According to CoinMetrics, after the approval of the ETF, the correlation between bitcoin and Ethereum decreased from about 0.8 to 0.7. This means that the price movements of the two assets have become less consistent.

Kostarev drew attention to the fact that altcoins are only now beginning to show positive dynamics. For example, the price of Uniswap (UNI), a token from the top 30 by capitalization, is at the level of the beginning of 2023, so altcoins retain a "decent margin for growth."

Cohen noted the lag between Ethereum and bitcoin in terms of growth throughout 2023. However, after the launch of the ETF, there was a natural "overflow from the overbought first cryptocurrency into ETH, which has become more attractive for investment at the moment," the trader added.

Recall that analysts at 10x Research drew attention to the discrepancy between the price of the first cryptocurrency and the RSI indicator, which may indicate the risks of further bitcoin falling to dynamic support at $38,000.

Go back